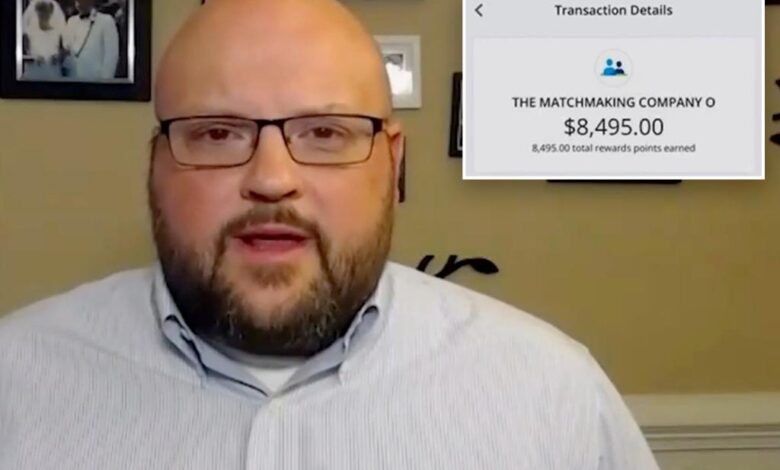

80-year-old dementia patient signs up for matchmaking service — and racks up $8,500 tab

The son of an elderly Florida man says he was shocked to find an $8,500 charge on his dad’s credit card from a matchmaking service — given his pop has dementia and couldn’t go on a date if he wanted to.

To add insult to injury, the Oklahoma firm — called The Matchmaking Company — only gave a partial refund after a Florida news station began poking around, according to News 6 in Orlando.

The 80-year-old man’s son, Blake Mooney, said that at first, he tried to get the money back on his own. But he was stymied by the company’s Byzantine call system, he said.

“There’s nobody to talk to,” the North Carolina man told the station. “There’s nobody who can help you in any way other than [asking], ‘Would you like to sign up? Would you like to have some matchmaking done for you?’ ”

The family’s saga began in June, when Mooney’s dad took a ride-share from a Lake County assisted-living facility to The Matchmaking Company’s Winter Park office, News 6 said.

A half-hour later, the elderly man signed a contract that entitled him to 12 dates for a whopping $8,495.

His dad’s mental state isn’t always readily apparent, Mooney said. But it would surface fairly quickly during an in-depth conversation, the son said.

“Once [the conversation] starts involving financial situations, numbers and dates, he would have no idea,” Mooney said. “You could call him right now and ask him what the date is, and he wouldn’t be able to recall it for you.”

For example, his dad listed his birth year as 1922 on the application paperwork, which would have made the octogenarian about 102 years old, the station said.

Mooney isn’t even sure how his widower dad found the company, which claims to “create long-lasting, authentic, and loving relationships” for clients.

“He can’t go on a date,” said Mooney, who added that his dad barely recalls signing the contract. “He’s got dementia.”

That created a big issue for his son, who was left to figure out how to clean up the mess.

“For the family members, you have to understand that, absent some court order, there’s going to be that freedom to enter into contracts,” Raymond Traendly, a lawyer with TK Law in Altamonte Springs, Fla., told the station.

“There’s going to be that freedom to swipe that credit card and make those purchases. And then it becomes your burden to prove that your family member didn’t have capacity at that time.”

Mooney said he called the firm dozens of times, to no avail, to try to sort things out.

On the rare occasion that he did talk to a live representative, he didn’t get anywhere — they weren’t interested in hearing about his dad’s dilemma or getting him a refund, he said.

News 6 eventually began asking about the incident, and a reporter visited the Winter Park office, the station said.

Afterward, the company’s corporate counsel called Mooney and said they’d spoke to his dad, who denied having dementia.

But Mooney — who has power of attorney over his elderly father — sent the company a doctor’s letter that said his dad had, in fact, been diagnosed and “experiences significant cognitive impairment that affects memory, reasoning, and judgment.

“After comprehensive evaluation and clinical assessments, it is my professional medical opinion that he lacks the capacity to make sound decisions regarding the use of [The Matchmaking Company’s] services,” the letter said.

The company canceled the contract begrudgingly and gave a $6,000 refund, News 6 said.

The firm wouldn’t explain why it kept the $2,500 — or comment about anything else, despite repeated inquiries from the station.

For his part, Mooney is just happy to get most of the cash back.

“This would have financially killed him,” Mooney said of his father and the situation. “It would have been bad had we not caught it. It would have been very bad.”