What if Russia blocks the export of its raw materials? – DW – 10/06/2024

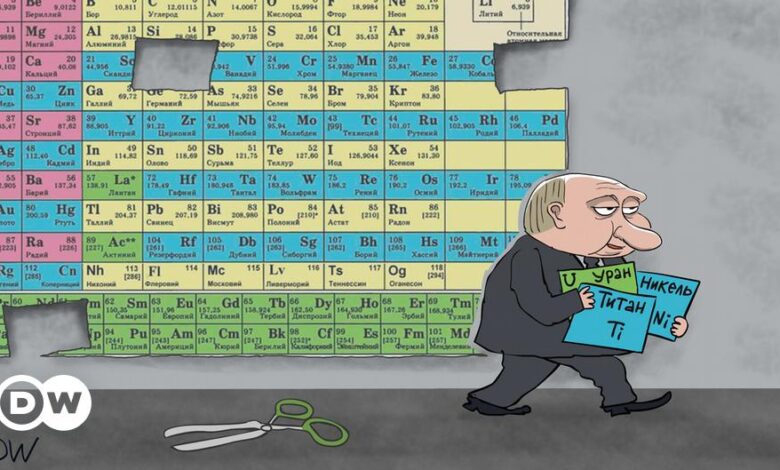

“Supplies of a number of goods to us will be limited, and we should perhaps also think about certain restrictions, for example on uranium, titanium and nickel,” Russian President Vladimir Putin said in mid-September, instructing his government to consider curbing exports.

The Kremlin already tried to pressure Europe with regard to gas supplies in 2022. The aim was to undermine the West’s support for Ukraine in its resistance to Russia’s war of aggression. His latest threat is significant, as the United States and European Union import these raw materials from Russia in large quantities.

The role of Russian uranium

It’s no coincidence that Putin mentioned uranium first. The state-owned Russian company Rosatom holds over 40% of the world market for the enriched uranium needed to operate nuclear power plants. No other country offers such high-quality, low-enriched uranium for new-generation reactors. US company Centrus Energy was the first to start its own uranium enrichment at the end of last year, but production volumes will remain modest for the foreseeable future. Centrus Energy’s main business is in fact the supply of enriched uranium that it purchases from Rosatom.

Overall, Rosatom’s share of the US market is more than 20%, and around 30% in the EU. As the largest buyer of enriched uranium from Russia, the US accounts for half of Rosatom’s foreign sales, which amount to around $2 billion (€1.8 billion) per year. Rosatom’s uranium deliveries to the EU amount to around $500 million (€455 million).

Rosatom also supplies finished fuel and services for nuclear power plants of Soviet and Russian design. According to its own figures, in 2023 the company generated over $4 billion (€3.64 billion) of its total global turnover of $16.4 billion (€14.9 billion) in Western countries.

How Russia circumvents sanctions

Breaking off sales would be painful for both sides, which is why until recently Rosatom was one of the few Russian companies that was not subject to Western sanctions. Nevertheless, it has become clear in the West that nuclear energy sector dependencies on Russia must be reduced. Only Hungarian President Viktor Orban takes a different view.

In addition to Rosatom, two European companies, Urenco and Orano, also enrich uranium in large quantities. Both are expanding their capacities to increase supplies to the important US market. If this succeeds, the US could do without Russian supplies in about five years, and the EU a little later, says Dmitry Gorchakov, a nuclear expert at Bellona, a non-profit that supports sustainable environmental policy in various industrial sectors.

US companies have also recently been importing more enriched uranium from China. Though this is presumably resold uranium from Russia, which has increased deliveries to its most important trading partner China significantly since 2022. This shows that, despite sanctions, Russian raw materials can still reach the US market via other channels.

Navigating titanium dependencies

Titanium production in Russia is almost exclusively in the hands of VSMPO-Avisma, a company based in the Ural Mountains. It produces around 15% of the world’s titanium sponge, a raw material from which titanium ingots are cast for widespread use in the manufacture of components for the aerospace, automotive, medical, and chemical industries. By comparison, more than half of the world’s available titanium sponge is produced in China, slightly less than a quarter in Japan and just under 10% in Kazakhstan.

Like Rosatom, VSMPO-Avisma is also affected by US sanctions, though not by EU sanctions. Before the war in Ukraine, VSMPO-Avisma’s main customers abroad were the US aircraft company Boeing and its European competitor Airbus. VSMPO-Avisma covered around a third of Boeing’s titanium requirements and more than half of Airbus’s needs. But Boeing announced the end of its cooperation with VSMPO-Avisma after the start of the war in spring 2022, and Airbus followed suit in December of the same year.

Prior to this, Airbus CEO Guillaume Faury had spoken out against punitive measures, as this would have been tantamount to sanctions against his own company. In view of the complex production processes and dependencies in the aerospace industry it is almost impossible to switch seamlessly to other suppliers.

However, American companies are allowed to cooperate with VSMPO-Avisma under certain conditions. Canada’s sanctions against the Russian company also provide for exceptions, for example for the aircraft manufacturers Bombardier and Airbus. Many Boeing suppliers, including the French component manufacturer Safran and the British engine manufacturer Rolls-Royce, also continue to source titanium from Russia. Airbus did so until at least November 2023 (more recent trade data from the ImportGenius database is not yet available). Exports from VSMPO-Avisma to Europe amounted to $345 million in 2023 compared to $370 million in the previous year.

Unlike the EU, the US can more easily reduce its dependence on Russia because it has companies that process imported titanium sponge, explains Andy Home, metals expert and columnist at Reuters news agency. The EU is therefore increasingly dependent on the US for titanium, which contradicts the EU law on critical raw materials passed this year. But for the time being, the EU has no other choice.

An uncertain future for nickel

One of the largest nickel producers in the world, the Russian company Norilsk Nickel, was spared sanctions for quite a while. The US and UK only imposed restrictions a month ago, and the EU still has yet to do so.

Even so, the company’s exports changed after the war began. In 2021, Europe accounted for over 50% of Norilsk Nickel’s sales, with North and South America making up a further 16%, and Asia at 27%. In 2023, Europe’s share fell to 24%, while North and South America dropped to 10%. Asia’s share, on the other hand, rose to 54%.

This reorientation from West to East is not the only challenge for the Russian company. Demand for nickel has risen sharply in recent years because it is required for the production of lithium-ion batteries for electric vehicles. This, along with the fear of sanctions, has led to price fluctuations. Today, the price is lower than it was before Russia’s invaded Ukraine, thanks in part to Indonesia, which has significantly larger nickel deposits than Russia, and has unexpectedly entered this market. Norilsk Nickel’s prospects are therefore unclear, says Andy Home from Reuters.

Putin urged his government to avoid disadvantaging the country when examining possible export restrictions on Russian raw materials. But at least for now, Russia will not be able to use this particular raw material as a potential geopolitical weapon.

This article was originally written in German.